Nordea 1 Global Stab.Eq.F.Euro H.AP EUR

LU0305819384

Nordea 1 Global Stab.Eq.F.Euro H.AP EUR/ LU0305819384 /

| NAV2024-04-24 |

Chg.-0.0246 |

Type of yield |

Investment Focus |

Investment company |

| 18.6996EUR |

-0.13% |

paying dividend |

Equity

Worldwide

|

Nordea Inv. Funds ▶ |

Investment strategy

Der Fonds strebt langfristiges Kapitalwachstum für seine Anteilsinhaber an.

Das Managementteam wählt bei der aktiven Verwaltung des Fondsportfolios Unternehmen aus, die überdurchschnittliche Wachstumsaussichten und Anlagemerkmale bieten dürften. Der Fonds investiert vorwiegend in Aktien von Unternehmen weltweit. Insbesondere legt der Fonds mindestens 75% seines Gesamtvermögens in Aktien und aktienähnlichen Wertpapieren an.

Investment goal

Der Fonds strebt langfristiges Kapitalwachstum für seine Anteilsinhaber an.

Master data

| Type of yield: |

paying dividend |

| Funds Category: |

Equity |

| Region: |

Worldwide |

| Branch: |

Mixed Sectors |

| Benchmark: |

70% MSCI World Index (Net Return) hedged to EUR and 30% EURIBOR 1M |

| Business year start: |

01-01 |

| Last Distribution: |

2023-04-24 |

| Depository bank: |

JP Morgan SE, Luxembourg Branch |

| Fund domicile: |

Luxembourg |

| Distribution permission: |

Austria, Germany, Switzerland, United Kingdom |

| Fund manager: |

Claus Vorm & Robert Naess |

| Fund volume: |

583.32 mill.

EUR

|

| Launch date: |

2007-07-02 |

| Investment focus: |

- |

Conditions

| Issue surcharge: |

5.00% |

| Max. Administration Fee: |

1.50% |

| Minimum investment: |

0.00 EUR |

| Deposit fees: |

- |

| Redemption charge: |

0.00% |

| Key Investor Information: |

Download (Print version) |

Investment company

| Funds company: |

Nordea Inv. Funds |

| Address: |

562, Rue de Neudorf, 2017, Luxembourg |

| Country: |

Luxembourg |

| Internet: |

www.nordea.lu

|

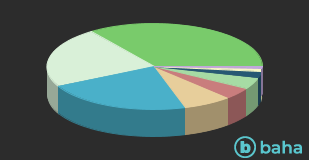

Countries

| United States of America |

|

64.00% |

| France |

|

7.88% |

| Germany |

|

4.31% |

| United Kingdom |

|

4.30% |

| Japan |

|

4.26% |

| Canada |

|

2.66% |

| Spain |

|

2.15% |

| Switzerland |

|

1.57% |

| Ireland |

|

1.34% |

| Hong Kong, SAR of China |

|

1.09% |

| Netherlands |

|

1.03% |

| Israel |

|

1.03% |

| Singapore |

|

0.89% |

| Taiwan, Province Of China |

|

0.89% |

| Portugal |

|

0.87% |

| Others |

|

1.73% |

Branches

| IT/Telecommunication |

|

35.04% |

| Consumer goods |

|

22.46% |

| Healthcare |

|

22.19% |

| Utilities |

|

7.45% |

| Finance |

|

4.35% |

| Industry |

|

4.23% |

| Commodities |

|

2.54% |

| real estate |

|

1.09% |

| Cash |

|

0.65% |