Sunares Sustainable Natural Resources

LU0344810915

Sunares Sustainable Natural Resources/ LU0344810915 /

| NAV2024-04-23 |

Chg.-0.0500 |

Type of yield |

Investment Focus |

Investment company |

| 66.5700EUR |

-0.08% |

paying dividend |

Equity

Worldwide

|

VP Fund Sol. (LU) ▶ |

Investment strategy

This is a sub-fund with environmental and/or social characteristics (Art. 8 Regulation (EU) 2019/2088, Disclosure Regulation).The fund pursues a stock-picker approach, for which continual optimisation is provided with the aid of a combination of fundamental, technical and market sentiment behavioural analyses. Following the ancient Chinese concepts, SUNARES has divided the world of investment into two parts: Yin and Yang, which are binary reciprocal actions for all life on Earth. The 'yin' symbolises the shady side of the mountain, and is associated with the basic elements of earth and water, along with the 'female' principle. Conversely, 'yang' stands for the sunny side of the mountain, which is connected to the elements of fire and air (the 'male principle').The central thesis and basis of SUNARES is the belief that this natural balance of the four basic earthly elements has very much lost its balance due to a disproportionate increase in the 'yang' sector (this concerns all of the industries associated with fire and air). Ever since the Gold Standard was abandoned in 1971, the finance sector as a whole has been transformed into an air element, which in turn implies an excessive surplus of yang energy. This led to the global expansion of the 'fiat money system', which allowed money to be printed without cover and money to be created 'out of thin air'. This change in the global monetary system led to excessive investment in financial assets and derivatives, something that had never been seen before.The investment world of the fund includes all the global companies that primarily deal with the basic elements of earth and water, i.e. our planet's natural resources, or companies which contribute to the more efficient and economical use of these resources.

Therefore, the fund is not linked to an index and it is able to act freely when weighting its sectors, varying its weighting according to changes on commodity and capital markets.The fund places particular emphasis on the following sectors: commodities, precious metals, water, agriculture, forestry, food products, energy and alternative energy.The responsibility for selecting individual assets lies with the fund management.The subfund continuously invests at least 51% of its assets in equities.

Investment goal

This is a sub-fund with environmental and/or social characteristics (Art. 8 Regulation (EU) 2019/2088, Disclosure Regulation).The fund pursues a stock-picker approach, for which continual optimisation is provided with the aid of a combination of fundamental, technical and market sentiment behavioural analyses. Following the ancient Chinese concepts, SUNARES has divided the world of investment into two parts: Yin and Yang, which are binary reciprocal actions for all life on Earth. The 'yin' symbolises the shady side of the mountain, and is associated with the basic elements of earth and water, along with the 'female' principle. Conversely, 'yang' stands for the sunny side of the mountain, which is connected to the elements of fire and air (the 'male principle').The central thesis and basis of SUNARES is the belief that this natural balance of the four basic earthly elements has very much lost its balance due to a disproportionate increase in the 'yang' sector (this concerns all of the industries associated with fire and air). Ever since the Gold Standard was abandoned in 1971, the finance sector as a whole has been transformed into an air element, which in turn implies an excessive surplus of yang energy. This led to the global expansion of the 'fiat money system', which allowed money to be printed without cover and money to be created 'out of thin air'. This change in the global monetary system led to excessive investment in financial assets and derivatives, something that had never been seen before.The investment world of the fund includes all the global companies that primarily deal with the basic elements of earth and water, i.e. our planet's natural resources, or companies which contribute to the more efficient and economical use of these resources.

Master data

| Type of yield: |

paying dividend |

| Funds Category: |

Equity |

| Region: |

Worldwide |

| Branch: |

Mixed Sectors |

| Benchmark: |

- |

| Business year start: |

02-01 |

| Last Distribution: |

- |

| Depository bank: |

VP Bank (Luxembourg) S.A. |

| Fund domicile: |

Luxembourg |

| Distribution permission: |

Austria, Germany, United Kingdom |

| Fund manager: |

- |

| Fund volume: |

- |

| Launch date: |

2008-02-14 |

| Investment focus: |

- |

Conditions

| Issue surcharge: |

5.00% |

| Max. Administration Fee: |

1.75% |

| Minimum investment: |

- EUR |

| Deposit fees: |

0.10% |

| Redemption charge: |

0.00% |

| Key Investor Information: |

Download (Print version) |

Investment company

| Funds company: |

VP Fund Sol. (LU) |

| Address: |

2, rue Edward Steichen, 2540, Luxembourg |

| Country: |

Luxembourg |

| Internet: |

vpfundsolutions.vpbank.com

|

Countries

| United States of America |

|

26.48% |

| Canada |

|

25.41% |

| Australia |

|

20.53% |

| Sweden |

|

5.50% |

| United Kingdom |

|

4.93% |

| Norway |

|

3.18% |

| France |

|

3.15% |

| Chile |

|

2.97% |

| Denmark |

|

2.77% |

| Germany |

|

2.41% |

| South Africa |

|

2.02% |

| Luxembourg |

|

0.36% |

| Switzerland |

|

0.29% |

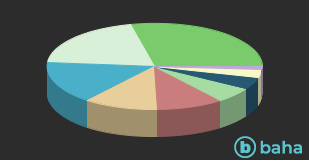

Branches

| Mining Metalls/Minerals |

|

28.55% |

| various sectors |

|

20.11% |

| Mining Precious Metals |

|

15.57% |

| IT/Telecommunication |

|

11.25% |

| Energy |

|

10.09% |

| Steel/Iron |

|

5.73% |

| Agriculture |

|

4.51% |

| Industry |

|

3.14% |

| groceries |

|

1.05% |