Invesco S.Gl.High Income Fd.A SDis USD

LU1775969659

Invesco S.Gl.High Income Fd.A SDis USD/ LU1775969659 /

| NAV2024-04-25 |

Chg.0.0000 |

Type of yield |

Investment Focus |

Investment company |

| 9.9000USD |

0.00% |

paying dividend |

Bonds

Worldwide

|

Invesco Management ▶ |

Investment strategy

The objective of the Fund is to achieve high income, together with long-term capital growth, while maintaining a lower carbon intensity than that of the Fund"s benchmark. The Fund intends to invest primarily in debt instruments issued worldwide, (including but not limited to debt issued by companies and governments ), which meet the Fund"s environmental, social and governance (ESG) criteria, as further detailed below.

The Fund may invest in non-investment grade (lower quality) and unrated debt instruments. The Fund may use securities lending for efficient portfolio management purposes. The Fund may invest in debt instruments which are in financial distress (distressed securities). Screening will be employed to exclude issuers that do not meet the Fund"s criteria, including, but not limited to, the level of involvement in certain activities such as coal, fossil fuels, tobacco, adult entertainment, cannabis and weapons. Positive screening will also be used, based on the investment manager"s proprietary rating system, to identify issuers with sufficient practice and standards or on an improving trajectory in terms of ESG and sustainable development for inclusion in the Fund"s universe, as measured by their ratings relative to their peers.

Investment goal

The objective of the Fund is to achieve high income, together with long-term capital growth, while maintaining a lower carbon intensity than that of the Fund"s benchmark. The Fund intends to invest primarily in debt instruments issued worldwide, (including but not limited to debt issued by companies and governments ), which meet the Fund"s environmental, social and governance (ESG) criteria, as further detailed below.

Master data

| Type of yield: |

paying dividend |

| Funds Category: |

Bonds |

| Region: |

Worldwide |

| Branch: |

Bonds: Mixed |

| Benchmark: |

Bloomberg Global High Yield Corporate Index USD-Hedged (Total Return) |

| Business year start: |

02-29 |

| Last Distribution: |

2024-03-01 |

| Depository bank: |

The Bank of New York Mellon SA/NV |

| Fund domicile: |

Luxembourg |

| Distribution permission: |

Austria, Germany, Switzerland |

| Fund manager: |

Niklas Nordenfelt, Rahim Shad, Philip Susser |

| Fund volume: |

150.87 mill.

USD

|

| Launch date: |

2018-10-08 |

| Investment focus: |

- |

Conditions

| Issue surcharge: |

5.00% |

| Max. Administration Fee: |

1.00% |

| Minimum investment: |

1,500.00 USD |

| Deposit fees: |

0.01% |

| Redemption charge: |

0.00% |

| Key Investor Information: |

Download (Print version) |

Investment company

| Funds company: |

Invesco Management |

| Address: |

An der Welle 5, 60322, Frankfurt am Main |

| Country: |

Germany |

| Internet: |

www.de.invesco.com

|

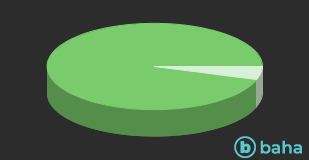

Assets

| Bonds |

|

88.92% |

| Mutual Funds |

|

9.29% |

| Cash |

|

0.95% |

| Stocks |

|

0.53% |

| Others |

|

0.31% |

Countries

| United States of America |

|

50.07% |

| United Kingdom |

|

7.36% |

| Netherlands |

|

5.53% |

| Canada |

|

3.91% |

| Germany |

|

3.55% |

| Cayman Islands |

|

3.27% |

| Bermuda |

|

2.84% |

| France |

|

2.76% |

| Luxembourg |

|

2.41% |

| Mexico |

|

1.79% |

| Cash |

|

0.95% |

| Liberia |

|

0.74% |

| Sweden |

|

0.66% |

| China |

|

0.55% |

| Italy |

|

0.55% |

| Others |

|

13.06% |

Currencies

| US Dollar |

|

95.05% |

| Others |

|

4.95% |