Metzler European Smaller Companies S.A

IE0002921975

Metzler European Smaller Companies S.A/ IE0002921975 /

| NAV2024-04-19 |

Chg.-2.0200 |

Type of yield |

Investment Focus |

Investment company |

| 338.2300EUR |

-0.59% |

paying dividend |

Equity

Europe

|

Universal-Inv. (IE) ▶ |

Investment strategy

The Fund is actively managed. The investment objective of the Fund is to increase the value of its investments over the long term.

The Fund will predominantly invest, on a diversified basis, its assets in European equities and equity related securities. Investment focus will be on medium to small companies, measured by market capitalisation (the value of the issued shares of a publicly traded company). The Fund may perform derivative trades in order to hedge positions or to increase its returns. The Fund is actively managed with reference to the STOXX Europe Small 200 NR (EUR) as a performance measure. The Investment Manager has full discretion over the Fund"s investments therefore the portfolio and performance may deviate significantly from the index. This Share Class is distributing in nature and may distribute on an annual basis.

Investment goal

The Fund is actively managed. The investment objective of the Fund is to increase the value of its investments over the long term.

Master data

| Type of yield: |

paying dividend |

| Funds Category: |

Equity |

| Region: |

Europe |

| Branch: |

Mixed Sectors |

| Benchmark: |

STOXX Europe Small 200 NR (EUR) |

| Business year start: |

10-01 |

| Last Distribution: |

2020-12-18 |

| Depository bank: |

Brown Brothers Harriman Trustee Services (Ireland) Limited |

| Fund domicile: |

Ireland |

| Distribution permission: |

Austria, Germany, Switzerland, United Kingdom |

| Fund manager: |

- |

| Fund volume: |

394.01 mill.

EUR

|

| Launch date: |

1998-01-02 |

| Investment focus: |

Small Cap |

Conditions

| Issue surcharge: |

5.00% |

| Max. Administration Fee: |

1.50% |

| Minimum investment: |

- EUR |

| Deposit fees: |

0.60% |

| Redemption charge: |

2.00% |

| Key Investor Information: |

Download (Print version) |

Investment company

| Funds company: |

Universal-Inv. (IE) |

| Address: |

Kilmore House,Spencer Dock, D01 YE64, Dublin |

| Country: |

Ireland |

| Internet: |

www.universal-investment.com

|

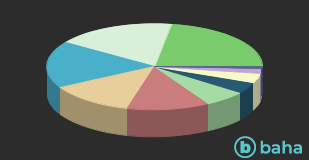

Countries

| France |

|

16.71% |

| Germany |

|

13.91% |

| United Kingdom |

|

12.69% |

| Sweden |

|

11.49% |

| Netherlands |

|

8.86% |

| Italy |

|

8.13% |

| Switzerland |

|

6.90% |

| Denmark |

|

4.16% |

| Norway |

|

4.07% |

| Austria |

|

3.42% |

| Luxembourg |

|

2.84% |

| Belgium |

|

2.46% |

| Faroe Islands |

|

1.67% |

| Cash |

|

1.64% |

| Ireland |

|

1.04% |

| Others |

|

0.01% |

Branches

| Industry |

|

22.53% |

| IT/Telecommunication |

|

18.00% |

| Finance |

|

17.67% |

| Consumer goods |

|

12.69% |

| Healthcare |

|

12.42% |

| Energy |

|

6.44% |

| Commodities |

|

3.99% |

| real estate |

|

3.81% |

| Cash |

|

1.64% |

| Utilities |

|

0.81% |