Jupiter Global Ecology Growth, Class D EUR A Inc Dist

LU1074971612

Jupiter Global Ecology Growth, Class D EUR A Inc Dist/ LU1074971612 /

| NAV2024-04-30 |

Chg.+0.0500 |

Type of yield |

Investment Focus |

Investment company |

| 20.3800EUR |

+0.25% |

paying dividend |

Equity

Worldwide

|

Jupiter AM Int. ▶ |

Investment strategy

The Fund's objective is to generate long-term capital growth and income by investing primarily in global equity securities that focus on making a positive impact towards environmental and sustainable objectives.

The Fund invests primarily (at least 70% of its Net Asset Value) in equity and equity-related securities globally (including emerging markets). The Fund's investments are issued by companies considered by the Investment Manager to be addressing global environmental and sustainability challenges by being substantially focused on activities generating or enabling a positive impact across any of the following sustainable solution themes: Clean energy, Green mobility, Green buildings and industry, Sustainable agriculture and land ecosystems, Sustainable oceans and freshwater systems, and Circular economy. Investments will be substantially orientated towards the sustainable solutions themes (typically by assessing indicators such as the level of revenue, profit or capital expenditure related to economic activity that is contributing to the themes) which in turn focuses the investment universe on a sub-set of equity securities.

Investment goal

The Fund's objective is to generate long-term capital growth and income by investing primarily in global equity securities that focus on making a positive impact towards environmental and sustainable objectives.

Master data

| Type of yield: |

paying dividend |

| Funds Category: |

Equity |

| Region: |

Worldwide |

| Branch: |

Mixed Sectors |

| Benchmark: |

MSCI AC World Index |

| Business year start: |

10-01 |

| Last Distribution: |

2023-09-29 |

| Depository bank: |

Citibank Europe plc |

| Fund domicile: |

Luxembourg |

| Distribution permission: |

Austria, Germany, Switzerland |

| Fund manager: |

JON WALLACE, NOELLE GUO |

| Fund volume: |

18.1 mill.

EUR

|

| Launch date: |

2014-09-01 |

| Investment focus: |

- |

Conditions

| Issue surcharge: |

5.00% |

| Max. Administration Fee: |

0.50% |

| Minimum investment: |

500,000.00 EUR |

| Deposit fees: |

- |

| Redemption charge: |

0.00% |

| Key Investor Information: |

Download (Print version) |

Investment company

| Funds company: |

Jupiter AM Int. |

| Address: |

5, rue Heienhaff, L-1736, Luxemburg |

| Country: |

Luxembourg |

| Internet: |

www.jupiteram.com

|

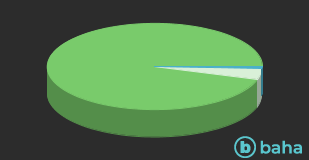

Assets

| Stocks |

|

95.25% |

| Cash |

|

4.09% |

| Mutual Funds |

|

0.66% |

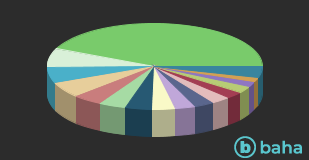

Countries

| United States of America |

|

43.32% |

| Denmark |

|

7.17% |

| France |

|

5.82% |

| Japan |

|

5.81% |

| Norway |

|

4.43% |

| Cash |

|

4.09% |

| Sweden |

|

4.04% |

| Switzerland |

|

3.52% |

| United Kingdom |

|

3.03% |

| Italy |

|

2.98% |

| Ireland |

|

2.97% |

| Germany |

|

2.62% |

| Canada |

|

2.56% |

| China |

|

1.80% |

| Luxembourg |

|

1.70% |

| Others |

|

4.14% |

Branches

| Industry |

|

51.23% |

| IT/Telecommunication |

|

18.09% |

| Commodities |

|

11.69% |

| Utilities |

|

6.65% |

| Healthcare |

|

4.46% |

| Cash |

|

4.09% |

| Consumer goods |

|

3.14% |

| Others |

|

0.65% |