Groupama Avenir Euro N

FR0010288308

Groupama Avenir Euro N/ FR0010288308 /

| NAV14.05.2024 |

Diff.+30,4800 |

Ertragstyp |

Ausrichtung |

Fondsgesellschaft |

| 1.965,8700EUR |

+1,57% |

thesaurierend |

Aktien

Euroland

|

Groupama AM ▶ |

Investmentstrategie

The investment objective of the product is to seek to outperform its benchmark index, the MSCI EMU Small Cap closing (net dividends reinvested) over the recommended investment period through active discretionary management, and after deduction of management fees. The product is a French UCITS fund, classed as equities from eurozone countries.

The product promotes environmental and/or social characteristics in accordance with Article 8 of the SFDR. The product portfolio is mainly composed of equities from eurozone countries. At least 75% of the product"s net assets are exposed to equities. It may invest up to 10% of its net assets in units or shares of French or foreign UCIs. The use of derivatives and securities with embedded derivatives for hedging and/or exposure purposes is limited to 20% of the net assets.

Investmentziel

The investment objective of the product is to seek to outperform its benchmark index, the MSCI EMU Small Cap closing (net dividends reinvested) over the recommended investment period through active discretionary management, and after deduction of management fees. The product is a French UCITS fund, classed as equities from eurozone countries.

Stammdaten

| Ertragstyp: |

thesaurierend |

| Fondskategorie: |

Aktien |

| Region: |

Euroland |

| Branche: |

Branchenmix |

| Benchmark: |

MSCI EMU Small Cap |

| Geschäftsjahresbeginn: |

29.02 |

| Letzte Ausschüttung: |

- |

| Depotbank: |

CACEIS BANK |

| Ursprungsland: |

Frankreich |

| Vertriebszulassung: |

Schweiz |

| Fondsmanager: |

Stéphane Fraenkel, Hervé Lorent |

| Fondsvolumen: |

651,89 Mio.

EUR

|

| Auflagedatum: |

25.04.2006 |

| Investmentfokus: |

- |

Konditionen

| Ausgabeaufschlag: |

3,00% |

| Max. Verwaltungsgebühr: |

1,87% |

| Mindestveranlagung: |

500,00 EUR |

| Weitere Gebühren: |

- |

| Tilgungsgebühr: |

0,00% |

| Wesentliche Anlegerinformation: |

- |

Fondsgesellschaft

| KAG: |

Groupama AM |

| Adresse: |

25 rue de la Ville l'Evêque, 75008, Paris |

| Land: |

Frankreich |

| Internet: |

www.groupama-am.com

|

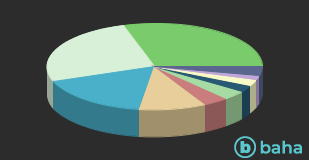

Länder

| Frankreich |

|

29,70% |

| Italien |

|

26,00% |

| Deutschland |

|

17,00% |

| Niederlande |

|

10,20% |

| Belgien |

|

3,70% |

| Schweiz |

|

3,60% |

| Österreich |

|

2,40% |

| Finnland |

|

2,40% |

| Luxemburg |

|

1,60% |

| Sonstige |

|

3,40% |

Branchen

| Informationstechnologie |

|

48,70% |

| Industrie |

|

20,00% |

| Konsumgüter zyklisch |

|

11,00% |

| Gesundheitswesen |

|

10,40% |

| Telekomdienste |

|

5,40% |

| Finanzen |

|

4,00% |

| Rohstoffe |

|

0,40% |

| Sonstige |

|

0,10% |