Invesco Env.Clim.Opport.Bd.Fd.A USD

LU0113592215

Invesco Env.Clim.Opport.Bd.Fd.A USD/ LU0113592215 /

| NAV2024-04-26 |

Chg.-0.0270 |

Type of yield |

Investment Focus |

Investment company |

| 9.5323USD |

-0.28% |

reinvestment |

Bonds

Worldwide

|

Invesco Management ▶ |

Investment strategy

The objective of the fund is to generate income and achieve medium to long term capital growth and to support the transition to a low carbon economy over the medium to long term.

The Fund invests primarily in debt instruments issued by investment grade companies worldwide, which meet the Fund"s environmental, social and governance (ESG) criteria as further detailed below. The Fund is, however, permitted to invest in debt instruments issued by non-investment grade or unrated companies. Screening will be employed to exclude issuers that do not meet the Fund"s criteria, including but not limited to, the level of involvement in certain activities such as fossil fuels as well as non-climate-related sectors such as unconventional weapons and tobacco.

Investment goal

The objective of the fund is to generate income and achieve medium to long term capital growth and to support the transition to a low carbon economy over the medium to long term.

Master data

| Type of yield: |

reinvestment |

| Funds Category: |

Bonds |

| Region: |

Worldwide |

| Branch: |

Bonds: Mixed |

| Benchmark: |

85 % ICE BofA Global Corporate Index USD-Hedged (Total Return), 15 % ICE BofA Global HY Index USD Hedged (TR) |

| Business year start: |

02-29 |

| Last Distribution: |

- |

| Depository bank: |

The Bank of New York Mellon SA/NV |

| Fund domicile: |

Luxembourg |

| Distribution permission: |

Austria, Germany, Switzerland |

| Fund manager: |

Michael Matthews, Tom Hemmant |

| Fund volume: |

61.37 mill.

USD

|

| Launch date: |

2000-07-03 |

| Investment focus: |

- |

Conditions

| Issue surcharge: |

5.00% |

| Max. Administration Fee: |

0.75% |

| Minimum investment: |

1,500.00 USD |

| Deposit fees: |

0.01% |

| Redemption charge: |

0.00% |

| Key Investor Information: |

Download (Print version) |

Investment company

| Funds company: |

Invesco Management |

| Address: |

An der Welle 5, 60322, Frankfurt am Main |

| Country: |

Germany |

| Internet: |

www.de.invesco.com

|

Assets

| Bonds |

|

98.49% |

| Mutual Funds |

|

0.90% |

| Cash |

|

0.60% |

| Others |

|

0.01% |

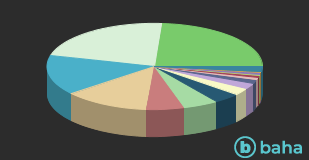

Countries

| United Kingdom |

|

23.89% |

| United States of America |

|

22.08% |

| Netherlands |

|

15.04% |

| France |

|

12.75% |

| Germany |

|

5.74% |

| Spain |

|

5.35% |

| Italy |

|

3.96% |

| Ireland |

|

2.63% |

| Supranational |

|

2.17% |

| Switzerland |

|

1.33% |

| Japan |

|

0.98% |

| Singapore |

|

0.63% |

| Cash |

|

0.60% |

| Denmark |

|

0.52% |

| Indonesia |

|

0.32% |

| Others |

|

2.01% |

Currencies

| US Dollar |

|

99.29% |

| Others |

|

0.71% |