Capital Group Emerging Markets Local Currency Debt Fund (LUX) Z EUR

LU0815114979

Capital Group Emerging Markets Local Currency Debt Fund (LUX) Z EUR/ LU0815114979 /

| NAV2024-05-15 |

Chg.+0.0200 |

Type of yield |

Investment Focus |

Investment company |

| 11.0400EUR |

+0.18% |

reinvestment |

Bonds

Emerging Markets

|

Capital Int. M. Co. ▶ |

Investment strategy

The fund seeks to provide a high level of longterm total return, of which current income is a significant component, by investing primarily in local currency denominated government and corporate bonds.

Essential features The fund invests primarily in bonds that are admitted to an official listing or traded on other regulated markets. The fund normally invests in bonds of issuers in emerging markets, in countries with a credit rating of Ba or lower or BB or lower, in countries that are or have been in the past five years on an International Monetary Fund ("IMF") program, or in countries that have outstanding liabilities with the IMF.

Investment goal

The fund seeks to provide a high level of longterm total return, of which current income is a significant component, by investing primarily in local currency denominated government and corporate bonds.

Master data

| Type of yield: |

reinvestment |

| Funds Category: |

Bonds |

| Region: |

Emerging Markets |

| Branch: |

Bonds: Mixed |

| Benchmark: |

JPM GBI-EM Global Diversified Total Return |

| Business year start: |

01-01 |

| Last Distribution: |

- |

| Depository bank: |

J.P. Morgan SE - Luxembourg Branch |

| Fund domicile: |

Luxembourg |

| Distribution permission: |

Austria, Germany, Switzerland |

| Fund manager: |

L. Freitas de Oliveira, K. Spence |

| Fund volume: |

1.66 bill.

USD

|

| Launch date: |

2013-04-25 |

| Investment focus: |

- |

Conditions

| Issue surcharge: |

5.25% |

| Max. Administration Fee: |

0.75% |

| Minimum investment: |

0.00 EUR |

| Deposit fees: |

0.14% |

| Redemption charge: |

0.00% |

| Key Investor Information: |

Download (Print version) |

Investment company

| Funds company: |

Capital Int. M. Co. |

| Address: |

37A, Avenue J-F Kennedy, 1855, Luxemburg |

| Country: |

Luxembourg |

| Internet: |

www.capitalgroup.com

|

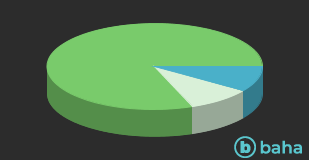

Assets

| Bonds |

|

80.82% |

| Cash |

|

9.61% |

| Others |

|

9.57% |

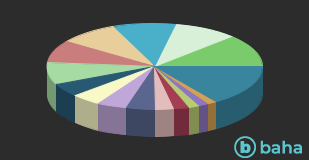

Countries

| Indonesia |

|

12.30% |

| Cash |

|

9.61% |

| South Africa |

|

9.42% |

| Mexico |

|

8.86% |

| Poland |

|

8.48% |

| Malaysia |

|

8.24% |

| Thailand |

|

4.94% |

| Brazil |

|

4.46% |

| China |

|

4.43% |

| Colombia |

|

4.40% |

| Czech Republic |

|

2.84% |

| Romania |

|

2.24% |

| India |

|

1.64% |

| Peru |

|

1.49% |

| Supranational |

|

1.36% |

| Others |

|

15.29% |

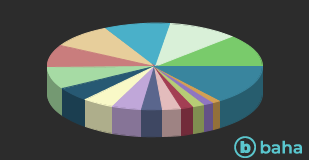

Currencies

| Indonesian Rupiah |

|

12.30% |

| Mexican Peso |

|

10.47% |

| Brazilian Real |

|

9.85% |

| South African Rand |

|

9.42% |

| Polish Zloty |

|

8.48% |

| Malaysian Ringgit |

|

8.24% |

| Thai Baht |

|

5.24% |

| Colombian Peso |

|

4.66% |

| Chinese Yuan Renminbi |

|

4.43% |

| Indian Rupee |

|

3.10% |

| Czech Koruna |

|

2.84% |

| Chilean Peso |

|

1.88% |

| Euro |

|

1.85% |

| Peruvian Nuevo Sol |

|

1.49% |

| Hungarian Forint |

|

1.20% |

| Others |

|

14.55% |