Groupama Avenir Euro I

FR0000990038

Groupama Avenir Euro I/ FR0000990038 /

| NAV2024-04-26 |

Chg.+74.5205 |

Type of yield |

Investment Focus |

Investment company |

| 14,551.2803EUR |

+0.51% |

reinvestment |

Equity

Euroland

|

Groupama AM ▶ |

Investment strategy

The investment objective of the product is to seek to outperform its benchmark index, the MSCI EMU Small Cap closing (net dividends reinvested) over the recommended investment period through active discretionary management, and after deduction of management fees. The product is a French UCITS fund, classed as equities from eurozone countries.

The product promotes environmental and/or social characteristics in accordance with Article 8 of the SFDR. The product portfolio is mainly composed of equities from eurozone countries. At least 75% of the product"s net assets are exposed to equities. It may invest up to 10% of its net assets in units or shares of French or foreign UCIs. The use of derivatives and securities with embedded derivatives for hedging and/or exposure purposes is limited to 20% of the net assets.

Investment goal

The investment objective of the product is to seek to outperform its benchmark index, the MSCI EMU Small Cap closing (net dividends reinvested) over the recommended investment period through active discretionary management, and after deduction of management fees. The product is a French UCITS fund, classed as equities from eurozone countries.

Master data

| Type of yield: |

reinvestment |

| Funds Category: |

Equity |

| Region: |

Euroland |

| Branch: |

Mixed Sectors |

| Benchmark: |

MSCI EMU Small Cap |

| Business year start: |

02-29 |

| Last Distribution: |

- |

| Depository bank: |

CACEIS BANK |

| Fund domicile: |

France |

| Distribution permission: |

Switzerland |

| Fund manager: |

Stéphane Fraenkel, Hervé Lorent |

| Fund volume: |

627.39 mill.

EUR

|

| Launch date: |

1994-04-15 |

| Investment focus: |

- |

Conditions

| Issue surcharge: |

3.00% |

| Max. Administration Fee: |

1.50% |

| Minimum investment: |

150,000.00 EUR |

| Deposit fees: |

- |

| Redemption charge: |

0.00% |

| Key Investor Information: |

- |

Investment company

| Funds company: |

Groupama AM |

| Address: |

25 rue de la Ville l'Evêque, 75008, Paris |

| Country: |

France |

| Internet: |

www.groupama-am.com

|

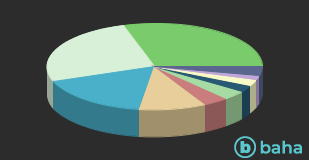

Countries

| France |

|

29.70% |

| Italy |

|

26.00% |

| Germany |

|

17.00% |

| Netherlands |

|

10.20% |

| Belgium |

|

3.70% |

| Switzerland |

|

3.60% |

| Austria |

|

2.40% |

| Finland |

|

2.40% |

| Luxembourg |

|

1.60% |

| Others |

|

3.40% |

Branches

| IT |

|

48.70% |

| Industry |

|

20.00% |

| Consumer goods, cyclical |

|

11.00% |

| Healthcare |

|

10.40% |

| Telecommunication Services |

|

5.40% |

| Finance |

|

4.00% |

| Commodities |

|

0.40% |

| Others |

|

0.10% |