Invesco STOXX Europe 600 Optimised Basic Resources UCITS ETF Acc

IE00B5MTWY73

Invesco STOXX Europe 600 Optimised Basic Resources UCITS ETF Acc/ IE00B5MTWY73 /

| NAV2024-05-02 |

Chg.-0.9901 |

Type of yield |

Investment Focus |

Investment company |

| 599.9188EUR |

-0.16% |

reinvestment |

Equity

Worldwide

|

Invesco IM ▶ |

Investment strategy

The objective of the Fund is to aim to track the Net Total Return performance of the STOXX Europe 600 Optimised Basic Resources Index (the "Index"), less fees, expenses and transaction costs. The Fund"s base currency is EUR.The Index represents the basic resources sector of the European market. The Index is derived from the STOXX Europe 600 Supersector Basic Resources Index. The Index provides a representation of STOXX Limited sector leaders based on the Industry Classification Benchmark and captures equal or improved liquidity and country diversification of the STOXX Europe 600 Index.

The Index applies a sector dependent liquidity cap that reduces the weighting of only those constituents whose average daily turnover, as a fraction of its free float market cap is below the sector average. This hybrid market cap and with the liquidity weighting methodology optimizes the tradability of the Index while retaining the free float market capitalisation weighting across the larger and more liquid constituents. The Index is weighted by free float market capitalisation and the composition and free float weights are reviewed quarterly. The Index is rebalanced on a quarterly basis. Investors should note that the Index is the intellectual property of the index provider.To achieve the objective the Fund will use unfunded swaps ("Swaps"). These Swaps are an agreement between the Fund and an approved counterparty to exchange one stream of cash flows against another stream but do not require the Fund to provide collateral, on the basis that the Fund has already invested in a basket of equities and equity related securities (namely shares).

Investment goal

The objective of the Fund is to aim to track the Net Total Return performance of the STOXX Europe 600 Optimised Basic Resources Index (the "Index"), less fees, expenses and transaction costs. The Fund"s base currency is EUR.The Index represents the basic resources sector of the European market. The Index is derived from the STOXX Europe 600 Supersector Basic Resources Index. The Index provides a representation of STOXX Limited sector leaders based on the Industry Classification Benchmark and captures equal or improved liquidity and country diversification of the STOXX Europe 600 Index.

Master data

| Type of yield: |

reinvestment |

| Funds Category: |

Equity |

| Region: |

Worldwide |

| Branch: |

ETF Stocks |

| Benchmark: |

STOXX Europe 600 Optimised Basic Resources Index (EUR) |

| Business year start: |

12-01 |

| Last Distribution: |

- |

| Depository bank: |

Northern Trust Fiduciary Services (Irel) |

| Fund domicile: |

Ireland |

| Distribution permission: |

Austria, Germany, United Kingdom |

| Fund manager: |

Assenagon Asset Management S.A. |

| Fund volume: |

39.71 mill.

EUR

|

| Launch date: |

2009-07-08 |

| Investment focus: |

- |

Conditions

| Issue surcharge: |

0.00% |

| Max. Administration Fee: |

0.20% |

| Minimum investment: |

1.00 EUR |

| Deposit fees: |

- |

| Redemption charge: |

0.00% |

| Key Investor Information: |

Download (Print version) |

Countries

| Australia |

|

20.50% |

| Switzerland |

|

19.20% |

| Sweden |

|

15.30% |

| South Africa |

|

14.70% |

| Finland |

|

11.00% |

| Luxembourg |

|

7.00% |

| Chile |

|

4.20% |

| Norway |

|

3.90% |

| Poland |

|

1.90% |

| Others |

|

2.30% |

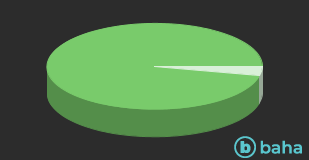

Branches

| Werkstoffe |

|

96.70% |

| Industry |

|

3.30% |