SEB Green Bond Fund - Klasse D (EUR)

LU0041441808

SEB Green Bond Fund - Klasse D (EUR)/ LU0041441808 /

| NAV2024-04-29 |

Chg.+0.0800 |

Type of yield |

Investment Focus |

Investment company |

| 48.4450EUR |

+0.17% |

paying dividend |

Bonds

Worldwide

|

SEB IM ▶ |

Investment strategy

The fund aims to contribute positively to climate transition in accordance with, among other things, the goal of the Paris Agreement, and to increase the value of your investment over time as well as to outperform its benchmark.

The fund is actively managed and invests globally, primarily in green bonds in the fixed-income market. Green bonds are bonds linked to investments that aim to reduce climate and environmental impact and contribute to sustainable development. At least 80% of the bonds that the fund invests in are green bonds, mainly rated investment grade, that aim to have a beneficial effect for the environment and the climate.

Investment goal

The fund aims to contribute positively to climate transition in accordance with, among other things, the goal of the Paris Agreement, and to increase the value of your investment over time as well as to outperform its benchmark.

Master data

| Type of yield: |

paying dividend |

| Funds Category: |

Bonds |

| Region: |

Worldwide |

| Branch: |

Bonds: Mixed |

| Benchmark: |

Bloomberg Barclays MSCI Green Bond Index 1-5 years |

| Business year start: |

01-01 |

| Last Distribution: |

2023-05-25 |

| Depository bank: |

Skandinaviska Enskilda Banken AB,LUX |

| Fund domicile: |

Luxembourg |

| Distribution permission: |

Austria, Germany, Luxembourg |

| Fund manager: |

Mikael Anttila, Mattias Ekström, Marianne Gut |

| Fund volume: |

263.28 mill.

EUR

|

| Launch date: |

1989-12-05 |

| Investment focus: |

- |

Conditions

| Issue surcharge: |

1.50% |

| Max. Administration Fee: |

0.40% |

| Minimum investment: |

- EUR |

| Deposit fees: |

- |

| Redemption charge: |

0.00% |

| Key Investor Information: |

Download (Print version) |

Investment company

| Funds company: |

SEB IM |

| Address: |

Stephanstraße 14 - 16, 60313, Frankfurt am Main |

| Country: |

Germany |

| Internet: |

seb.de/asset-management

|

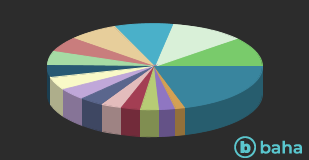

Countries

| Netherlands |

|

11.14% |

| Sweden |

|

11.12% |

| Spain |

|

8.88% |

| Norway |

|

7.47% |

| France |

|

5.66% |

| Finland |

|

5.26% |

| Japan |

|

4.75% |

| United States of America |

|

4.73% |

| Denmark |

|

4.40% |

| Germany |

|

3.49% |

| Belgium |

|

3.14% |

| Italy |

|

2.94% |

| Ireland |

|

2.78% |

| United Kingdom |

|

2.44% |

| Austria |

|

1.47% |

| Others |

|

20.33% |

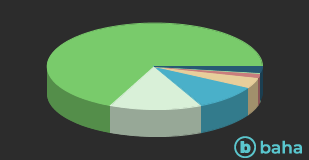

Currencies

| Euro |

|

68.32% |

| Swedish Krona |

|

13.94% |

| US Dollar |

|

9.58% |

| Norwegian Kroner |

|

4.01% |

| British Pound |

|

1.50% |

| Canadian Dollar |

|

0.26% |

| Others |

|

2.39% |