Invesco Markets p.NASDAQ-100 Sw.UE

IE000RUF4QN8

Invesco Markets p.NASDAQ-100 Sw.UE/ IE000RUF4QN8 /

| NAV2024-04-25 |

Chg.-0.2904 |

Type of yield |

Investment Focus |

Investment company |

| 52.8736USD |

-0.55% |

paying dividend |

Equity

ETF Stocks

|

Invesco IM ▶ |

Investment strategy

The objective of the Fund is to aim to track the Net Total Return performance of the NASDAQ-100 Index® (the "Index"), less fees, expenses and transaction costs. The Fund"s base currency is USD. The Index is designed to measure the performance of 100 of the largest Nasdaq-listed non-financial companies based on market capitalisation. To be eligible for inclusion in the Index, a security must meet all of the index provider"s eligibility criteria, as determined by the index provider: (1) The issuer of the security's primary US listing must exclusively be listed on the Nasdaq Global Select Market or the Nasdaq Global Market, (2) the security must be classified as a non-financial company, (3) the security must have a minimum three-month average daily trading volume of 200,000 shares, (4) the security must have traded for at least three full calendar months, not including the month of initial listing, on an eligible exchange, (5) if the issuer of the security is organised under the laws of a jurisdiction outside the US, then such security must have listed options on a recognized options market in the US or be eligible for listed-options trading on a recognized options market in the US, (6) the security may not be issued by an issuer currently in bankruptcy proceedings, (7) the issuer of the security generally may not have entered into a definitive agreement or other arrangement that would make it ineligible for inclusion in the Index and where the transaction is imminent as determined by the index provider, and (8) if an issuer has listed multiple security classes, all security classes are eligible, subject to meeting all other eligibility criteria. The Index rebalances quarterly. Investors should note that the Index is the intellectual property of the index provider. The Fund is not sponsored or endorsed by the index provider and a full disclaimer can be found in the Fund"s prospectus.

The Fund is a passively managed Exchange-Traded Fund. To achieve the objective the Fund will use unfunded swaps ("Swaps"). These Swaps are an agreement between the Fund and an approved counterparty to exchange one stream of cash flows against another stream but do not require the Fund to provide collateral, on the basis that the Fund has already invested in a basket of equities and equity related securities (namely shares). Please note that the Fund will purchase securities that are not contained in the Index. The performance of the Index is swapped from the counterparty to the Fund in exchange for the performance of equities and equity related securities held by the Fund.

Investment goal

The objective of the Fund is to aim to track the Net Total Return performance of the NASDAQ-100 Index® (the "Index"), less fees, expenses and transaction costs. The Fund"s base currency is USD. The Index is designed to measure the performance of 100 of the largest Nasdaq-listed non-financial companies based on market capitalisation.

Master data

| Type of yield: |

paying dividend |

| Funds Category: |

Equity |

| Country: |

United States of America |

| Branch: |

ETF Stocks |

| Benchmark: |

NASDAQ-100 Index® (USD) |

| Business year start: |

12-01 |

| Last Distribution: |

2024-03-14 |

| Depository bank: |

Northern Trust Fiduciary Serv. (IE) Lim. |

| Fund domicile: |

Ireland |

| Distribution permission: |

Austria, Germany, Switzerland |

| Fund manager: |

- |

| Fund volume: |

561.73 mill.

USD

|

| Launch date: |

2021-06-18 |

| Investment focus: |

- |

Conditions

| Issue surcharge: |

0.00% |

| Max. Administration Fee: |

0.20% |

| Minimum investment: |

1.00 USD |

| Deposit fees: |

- |

| Redemption charge: |

0.00% |

| Key Investor Information: |

Download (Print version) |

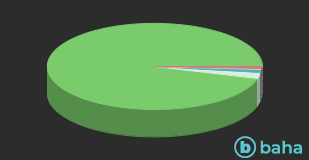

Countries

| United States of America |

|

95.60% |

| United Kingdom |

|

2.10% |

| Netherlands |

|

1.10% |

| Brazil |

|

0.60% |

| China |

|

0.60% |

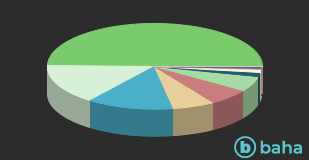

Branches

| IT |

|

49.60% |

| Telecommunication Services |

|

15.20% |

| Consumer goods |

|

13.00% |

| Basic Consumer Goods |

|

6.40% |

| Healthcare |

|

6.30% |

| Industry |

|

5.60% |

| Werkstoffe |

|

1.60% |

| Utilities |

|

1.20% |

| Energy |

|

0.50% |

| Finance |

|

0.50% |

| Others |

|

0.10% |