CT Pan European Foc.F.RNA GBP

GB00B01CWZ36

CT Pan European Foc.F.RNA GBP/ GB00B01CWZ36 /

| NAV2024-04-26 |

Chg.+0.0538 |

Type of yield |

Investment Focus |

Investment company |

| 4.8847GBP |

+1.11% |

reinvestment |

Equity

Europe

|

Threadneedle Inv. S. ▶ |

Investment strategy

The Fund aims to increase the value of your investment over the long term. It looks to outperform the MSCI Europe Index over rolling 3-year periods, after the deduction of charges. The Fund is actively managed, and invests at least 75% of its assets in a concentrated portfolio of shares of European (including UK) companies.

The Fund selects companies in which the fund manager has a high conviction that the current share price does not reflect the prospects for that business. These companies may be chosen from any industry or economic sector, with significant sector and share weightings taken at the fund manager"s discretion. There is no restriction on company size, however, investment tends to focus on larger companies, such as those included in the MSCI Europe Index. The MSCI Europe Index is regarded as providing an appropriate representation of the share performance of large and medium-sized companies within developed market countries across Europe (including the UK), currently with over 400 companies included. It provides a suitable target benchmark against which Fund performance will be measured and evaluated over time. The Fund typically invests in fewer than 50 companies, which may include shares of some companies not within the Index. The Fund may also invest in other assets such as cash and deposits, and hold other funds (including funds managed by Columbia Threadneedle companies) when deemed appropriate. The Fund is not permitted to invest in derivatives for investment purposes, but derivatives may be used with the aim of reducing risk or managing the Fund more efficiently. Derivatives are sophisticated investment instruments linked to the rise and fall of the price of other assets.

Investment goal

The Fund aims to increase the value of your investment over the long term. It looks to outperform the MSCI Europe Index over rolling 3-year periods, after the deduction of charges. The Fund is actively managed, and invests at least 75% of its assets in a concentrated portfolio of shares of European (including UK) companies.

Master data

| Type of yield: |

reinvestment |

| Funds Category: |

Equity |

| Region: |

Europe |

| Branch: |

Mixed Sectors |

| Benchmark: |

MSCI Europe Index |

| Business year start: |

05-01 |

| Last Distribution: |

- |

| Depository bank: |

Citibank UK Limited |

| Fund domicile: |

United Kingdom |

| Distribution permission: |

Switzerland |

| Fund manager: |

Frederic Jeanmaire |

| Fund volume: |

75.79 mill.

EUR

|

| Launch date: |

2004-07-12 |

| Investment focus: |

- |

Conditions

| Issue surcharge: |

5.00% |

| Max. Administration Fee: |

1.50% |

| Minimum investment: |

2,000.00 GBP |

| Deposit fees: |

0.01% |

| Redemption charge: |

0.00% |

| Key Investor Information: |

Download (Print version) |

Investment company

| Funds company: |

Threadneedle Inv. S. |

| Address: |

Cannon Place, 78 Cannon Street, EC4N 6AG, London |

| Country: |

United Kingdom |

| Internet: |

www.columbiathreadneedle.co.uk

|

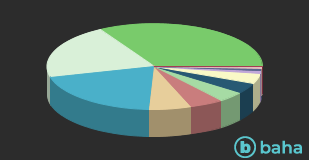

Countries

| France |

|

33.45% |

| Germany |

|

20.65% |

| United Kingdom |

|

20.11% |

| Sweden |

|

6.36% |

| Spain |

|

5.09% |

| Italy |

|

4.00% |

| Netherlands |

|

3.94% |

| Denmark |

|

3.84% |

| Ireland |

|

0.97% |

| Switzerland |

|

0.90% |

| Cash |

|

0.68% |

| Others |

|

0.01% |

Branches

| Industry |

|

48.28% |

| Consumer goods |

|

25.83% |

| Finance |

|

16.04% |

| IT/Telecommunication |

|

9.17% |

| Cash |

|

0.68% |