Amundi Fds.Euro Aggregate Bd.A EUR

LU0616241476

Amundi Fds.Euro Aggregate Bd.A EUR/ LU0616241476 /

| NAV2024-04-26 |

Chg.+0.4100 |

Type of yield |

Investment Focus |

Investment company |

| 124.4000EUR |

+0.33% |

reinvestment |

Bonds

Worldwide

|

Amundi Luxembourg ▶ |

Investment strategy

To achieve a combination of income and capital growth (total return).

The Sub-Fund invests at least 67% of assets in euro-denominated instruments. These are: - debt instruments issued by Eurozone governments or state agencies, or by supranational entities such as the World Bank - investment-grade corporate debt instruments - MBS (up to 20% of its net assets). The Sub-Fund invests at least 50% of net assets in bonds denominated in euro. The Sub-Fund makes use of derivatives to reduce various risks and for efficient portfolio management. The Sub-Fund may use credit derivatives (up to 40% of net assets). The Sub-Fund is actively managed by reference to and seeks to outperform the Bloomberg Euro Aggregate (E) Index. The Sub-Fund is mainly exposed to the issuers of the Benchmark, however, the management of the Sub-Fund is discretionary, and will be exposed to issuers not included in the Benchmark.

Investment goal

To achieve a combination of income and capital growth (total return).

Master data

| Type of yield: |

reinvestment |

| Funds Category: |

Bonds |

| Region: |

Worldwide |

| Branch: |

Bonds: Mixed |

| Benchmark: |

Bloomberg Euro Aggregate (E) Index |

| Business year start: |

07-01 |

| Last Distribution: |

- |

| Depository bank: |

CACEIS Bank, Luxembourg Branch |

| Fund domicile: |

Luxembourg |

| Distribution permission: |

Austria, Germany, Switzerland, United Kingdom |

| Fund manager: |

Isabelle Vic-Philippe, Hervé Boiral |

| Fund volume: |

934.02 mill.

EUR

|

| Launch date: |

2011-06-24 |

| Investment focus: |

- |

Conditions

| Issue surcharge: |

4.50% |

| Max. Administration Fee: |

0.80% |

| Minimum investment: |

0.00 EUR |

| Deposit fees: |

- |

| Redemption charge: |

0.00% |

| Key Investor Information: |

Download (Print version) |

Investment company

| Funds company: |

Amundi Luxembourg |

| Address: |

5 allée Scheffer, L-2520, Luxemburg |

| Country: |

Luxembourg |

| Internet: |

www.amundi.lu

|

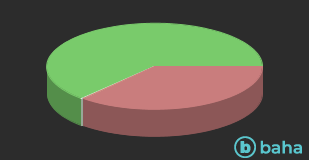

Assets

| Bonds |

|

62.38% |

| Derivative |

|

36.38% |

| Money Market |

|

1.24% |

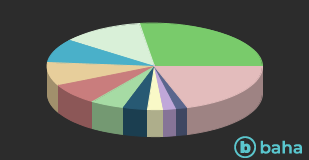

Countries

| Germany |

|

27.26% |

| Italy |

|

12.24% |

| Spain |

|

9.11% |

| France |

|

8.74% |

| Supranational |

|

7.94% |

| United States of America |

|

4.98% |

| Netherlands |

|

3.72% |

| Belgium |

|

2.32% |

| Portugal |

|

1.98% |

| United Kingdom |

|

1.69% |

| Others |

|

20.02% |

Currencies

| Euro |

|

63.18% |

| Japanese Yen |

|

0.31% |

| US Dollar |

|

0.07% |

| British Pound |

|

0.02% |

| Others |

|

36.42% |