Amundi Fds.Euroland Eq.Small Cap A EUR

LU0568607203

Amundi Fds.Euroland Eq.Small Cap A EUR/ LU0568607203 /

| NAV2024-04-26 |

Chg.+1.3300 |

Type of yield |

Investment Focus |

Investment company |

| 216.0900EUR |

+0.62% |

reinvestment |

Equity

Euroland

|

Amundi Luxembourg ▶ |

Investment strategy

To achieve long-term capital growth.

The Sub-Fund invests at least 75% of net assets in equities of companies that are headquartered and listed in the Eurozone, with a minimum of 51% of net assets in equities which have a market capitalisation below the maximum market capitalication of the benchmark. Investments may be extended to other European Union member states, depending on the expectations regarding which countries may subsequently become part of the Eurozone. The Sub-Fund makes use of derivatives to reduce various risks and for efficient portfolio management. Benchmark : The Sub-Fund is actively managed and seeks to outperform the MSCI EMU Small Cap Index. The Sub-Fund is mainly exposed to the issuers of the benchmark, however, the management of the Sub-Fund is discretionary, and will invest in issuers not included in the benchmark. The Sub- Fund monitors risk exposure in relation to the benchmark however the extent of deviation from the Benchmark is expected to be material. Further, the Sub-Fund has designated the benchmark as a reference benchmark for the purpose of the Disclosure Regulation. The Benchmark is a broad market index, which does not assess or include constituents according to environmental characteristics, and therefore is not aligned with the environmental characteristics promoted by the Sub-Fund.

Investment goal

To achieve long-term capital growth.

Master data

| Type of yield: |

reinvestment |

| Funds Category: |

Equity |

| Region: |

Euroland |

| Branch: |

Mixed Sectors |

| Benchmark: |

MSCI EMU Small Cap Index |

| Business year start: |

07-01 |

| Last Distribution: |

- |

| Depository bank: |

CACEIS Bank, Luxembourg |

| Fund domicile: |

Luxembourg |

| Distribution permission: |

Austria, Germany, Switzerland, United Kingdom |

| Fund manager: |

- |

| Fund volume: |

342.29 mill.

EUR

|

| Launch date: |

2011-06-24 |

| Investment focus: |

Small Cap |

Conditions

| Issue surcharge: |

4.50% |

| Max. Administration Fee: |

1.70% |

| Minimum investment: |

0.00 EUR |

| Deposit fees: |

- |

| Redemption charge: |

0.00% |

| Key Investor Information: |

Download (Print version) |

Investment company

| Funds company: |

Amundi Luxembourg |

| Address: |

5 allée Scheffer, L-2520, Luxemburg |

| Country: |

Luxembourg |

| Internet: |

www.amundi.lu

|

Assets

| Stocks |

|

98.07% |

| Cash and Other Assets |

|

1.93% |

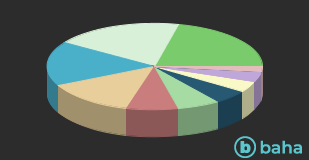

Countries

| France |

|

21.43% |

| Germany |

|

19.31% |

| Italy |

|

16.62% |

| Netherlands |

|

13.47% |

| Spain |

|

7.76% |

| Austria |

|

6.47% |

| Belgium |

|

5.17% |

| Finland |

|

3.95% |

| Ireland |

|

3.88% |

| Euroland |

|

0.01% |

| Others |

|

1.93% |

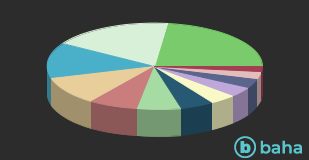

Branches

| Industry |

|

23.00% |

| Finance |

|

18.23% |

| IT |

|

13.17% |

| Consumer goods, cyclical |

|

10.64% |

| Commodities |

|

7.36% |

| real estate |

|

6.62% |

| Telecommunication Services |

|

5.10% |

| Basic Consumer Goods |

|

4.06% |

| Healthcare |

|

3.75% |

| Energy |

|

3.39% |

| various sectors |

|

2.75% |

| Cash / other assets |

|

1.93% |