DNCA Actions Euro PME R

FR0011891506

DNCA Actions Euro PME R/ FR0011891506 /

| NAV2024-05-21 |

Chg.-8.8301 |

Type of yield |

Investment Focus |

Investment company |

| 2,447.1299EUR |

-0.36% |

reinvestment |

Equity

Europe

|

DNCA FINANCE (LU) ▶ |

Investment strategy

The Fund's investment objective is to outperform the European markets for small, medium and mid-sized companies over a minimum recommended investment period of more than 5 years, by favouring a stock picking policy (i.e. selecting securities of listed companies according to their own characteristics and not according to the sector to which they belong), while selecting securities that meet socially responsible investment criteria, thus enabling the Fund to give priority to securities that, in the opinion of the Management Company, offer the best growth prospects. The performance of the Fund may be compared a posteriori, over the minimum recommended investment period, with the following composite benchmark MSCI EMU MICRO NR in euro.

To achieve its investment objective, the investment strategy is based on active discretionary management.

Investment goal

The Fund's investment objective is to outperform the European markets for small, medium and mid-sized companies over a minimum recommended investment period of more than 5 years, by favouring a stock picking policy (i.e. selecting securities of listed companies according to their own characteristics and not according to the sector to which they belong), while selecting securities that meet socially responsible investment criteria, thus enabling the Fund to give priority to securities that, in the opinion of the Management Company, offer the best growth prospects. The performance of the Fund may be compared a posteriori, over the minimum recommended investment period, with the following composite benchmark MSCI EMU MICRO NR in euro.

Master data

| Type of yield: |

reinvestment |

| Funds Category: |

Equity |

| Region: |

Europe |

| Branch: |

Mixed Sectors |

| Benchmark: |

MSCI EMU MICRO NR |

| Business year start: |

04-01 |

| Last Distribution: |

- |

| Depository bank: |

CACEIS Bank |

| Fund domicile: |

France |

| Distribution permission: |

Germany |

| Fund manager: |

Don FITZGERALD, Daniel DOURMAP, Simon DE FRANSSU |

| Fund volume: |

328.51 mill.

EUR

|

| Launch date: |

2014-08-28 |

| Investment focus: |

- |

Conditions

| Issue surcharge: |

2.00% |

| Max. Administration Fee: |

2.00% |

| Minimum investment: |

- EUR |

| Deposit fees: |

- |

| Redemption charge: |

0.00% |

| Key Investor Information: |

- |

Investment company

| Funds company: |

DNCA FINANCE (LU) |

| Address: |

19 place Vemdome, 75001, Paris |

| Country: |

France |

| Internet: |

www.dnca-investments.com

|

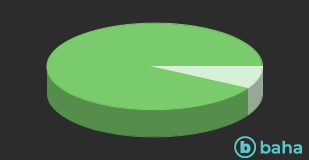

Assets

| Stocks |

|

91.80% |

| Cash and Other Assets |

|

8.20% |

Countries

| France |

|

46.70% |

| Italy |

|

19.56% |

| Germany |

|

12.38% |

| Spain |

|

5.69% |

| Finland |

|

4.59% |

| Belgium |

|

1.90% |

| Netherlands |

|

1.00% |

| Others |

|

8.18% |

Branches

| IT/Telecommunication |

|

29.10% |

| Industry |

|

15.60% |

| Healthcare |

|

14.50% |

| Consumer goods |

|

9.20% |

| Cash / other assets |

|

8.20% |

| Energy |

|

5.10% |

| Utilities |

|

4.50% |

| Retail |

|

3.70% |

| Chemicals |

|

2.40% |

| banks |

|

1.80% |

| automotive parts |

|

1.50% |

| Telecomunication |

|

1.40% |

| Financial Services |

|

1.20% |

| tourism services |

|

1.10% |

| Media |

|

0.70% |