iShares Euro Gov.Infl.-L.Bd.IF(IE)I.EUR

IE00B4WXT857

iShares Euro Gov.Infl.-L.Bd.IF(IE)I.EUR/ IE00B4WXT857 /

| NAV2024-04-26 |

Chg.+0.0509 |

Type of yield |

Investment Focus |

Investment company |

| 13.7588EUR |

+0.37% |

reinvestment |

Bonds

Euroland

|

BlackRock AM (IE) ▶ |

Investment strategy

The Fund aims to achieve a total return on your investment, through a combination of capital growth and income, which reflects the return of the Bloomberg Capital Euro Government Inflation-Linked Bond Index, the Fund"s benchmark index. The Fund invests predominantly in the fixed income (FI) securities (such as bonds) that make up the Fund"s benchmark index (which comprises Euro-denominated government inflation linked bonds) (i.e. bonds which pay income linked to a rate of inflation).

The FI securities may be issued by companies, governments, government agencies and supranationals (e.g. the International Bank for Reconstruction and Development) domiciled in countries both in and outside the European Union and will be investment grade (i.e. meet a specified level of credit worthiness) or are deemed by the investment manager to be of equivalent rating at the time of purchase. If the credit rating of a FI security is downgraded, the Fund may continue to hold this, until it is practicable to sell the position. The benchmark index measures the performance of the universe of inflation-linked bonds issued by governments of the European Monetary Union member states.

Investment goal

The Fund aims to achieve a total return on your investment, through a combination of capital growth and income, which reflects the return of the Bloomberg Capital Euro Government Inflation-Linked Bond Index, the Fund"s benchmark index. The Fund invests predominantly in the fixed income (FI) securities (such as bonds) that make up the Fund"s benchmark index (which comprises Euro-denominated government inflation linked bonds) (i.e. bonds which pay income linked to a rate of inflation).

Master data

| Type of yield: |

reinvestment |

| Funds Category: |

Bonds |

| Region: |

Euroland |

| Branch: |

Government Bonds |

| Benchmark: |

BBG Euro Government Inflation-Linked Bond Index (EUR) |

| Business year start: |

08-01 |

| Last Distribution: |

- |

| Depository bank: |

J.P. Morgan Bank (Ireland) plc |

| Fund domicile: |

Ireland |

| Distribution permission: |

Austria, Germany, Switzerland |

| Fund manager: |

Francis Rayner |

| Fund volume: |

136.4 mill.

EUR

|

| Launch date: |

2009-04-03 |

| Investment focus: |

- |

Conditions

| Issue surcharge: |

0.00% |

| Max. Administration Fee: |

0.10% |

| Minimum investment: |

500,000.00 EUR |

| Deposit fees: |

- |

| Redemption charge: |

0.00% |

| Key Investor Information: |

Download (Print version) |

Investment company

| Funds company: |

BlackRock AM (IE) |

| Address: |

12 Throgmorton Avenue, EC2N 2DL, London |

| Country: |

United Kingdom |

| Internet: |

www.blackrock.com

|

Assets

| Bonds |

|

99.94% |

| Others |

|

0.06% |

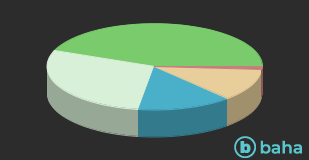

Countries

| France |

|

44.02% |

| Italy |

|

28.64% |

| Germany |

|

14.25% |

| Spain |

|

12.16% |

| Others |

|

0.93% |