LGT Sustainable Strategy 3 Years B EUR

LI0008232162

LGT Sustainable Strategy 3 Years B EUR/ LI0008232162 /

| NAV2024-05-06 |

Chg.+1.7799 |

Type of yield |

Investment Focus |

Investment company |

| 1,710.1899EUR |

+0.10% |

reinvestment |

Mixed Fund

Worldwide

|

LGT Capital P. (FL) ▶ |

Investment strategy

The fund is part of the umbrella fund LGT Multi-Assets SICAV. Each sub-fund pursues its own investment policy. However, periodic reports are generated at the level of the umbrella fund. The assets of the fund are strictly separated from the assets of the other parts of the umbrella fund. The Investor has the right to exchange his investment in units of one subfund for units of another subfund. Information about how to exercise that right can be obtained in the constituting documents of the (sub-)fund. The fund's investment objective is to achieve the highest possible capital appreciation. The fund is actively managed without reference to a benchmark.

The Sub-Fund is a feeder UCITS, which permanently invests at least 85% of its net asset value in the Master Fund (LGT CP Sustainable Strategy 3 Years, a sub-fund of LGT CP Multi-Assets SICAV) and up to 15% of its assets in liquid assets. The Sub-Fund aims to ensure that its performance is as similar as possible to that of the Master Fund, although there may be differences, inter alia, due to deviating fee structures. The investment objective of the Sub-Fund is for the Sub-Fund investors to participate in the performance of the Master Fund. The investment objective of the Master Fund is to achieve reasonable capital growth. The Master Fund will seek to achieve the investment objective by investing primarily in a broad range of fixed income and equity securities from issuers from Emerging Markets. "Emerging Markets" are countries that are in the process of developing into modern industrialized nations and therefore offer a high potential but also an elevated risk. The Master Fund max be (indirectly) exposed to the economic risks of various assets classes including commodities, hedge funds, private equity or real estate (indirectly) which have an alternative investment strategy. By regularly reviewing the risk-return ratios of various market segments and investments the Master Fund intends to minimize the probability of portfolio losses after the recommended minimum holding period of three years. The Master Fund may invest in derivatives (financial instruments derived from other securities or assets) for hedging purposes, efficient portfolio management and/or investment purposes. Environmental, social and governance (ESG) aspects are considered as part of the Master Fund's investment process. The Master Fund's portfolio is actively managed, not in reference to a benchmark. Derivatives may be only used to offset asset price movements (hedging).

Investment goal

The fund is part of the umbrella fund LGT Multi-Assets SICAV. Each sub-fund pursues its own investment policy. However, periodic reports are generated at the level of the umbrella fund. The assets of the fund are strictly separated from the assets of the other parts of the umbrella fund. The Investor has the right to exchange his investment in units of one subfund for units of another subfund. Information about how to exercise that right can be obtained in the constituting documents of the (sub-)fund. The fund's investment objective is to achieve the highest possible capital appreciation. The fund is actively managed without reference to a benchmark.

Master data

| Type of yield: |

reinvestment |

| Funds Category: |

Mixed Fund |

| Region: |

Worldwide |

| Branch: |

Multi-asset |

| Benchmark: |

- |

| Business year start: |

06-01 |

| Last Distribution: |

- |

| Depository bank: |

LGT Bank AG |

| Fund domicile: |

Liechtenstein |

| Distribution permission: |

Austria, Germany, Switzerland |

| Fund manager: |

- |

| Fund volume: |

401.28 mill.

EUR

|

| Launch date: |

1999-11-10 |

| Investment focus: |

- |

Conditions

| Issue surcharge: |

3.00% |

| Max. Administration Fee: |

1.30% |

| Minimum investment: |

1.00 EUR |

| Deposit fees: |

- |

| Redemption charge: |

0.00% |

| Key Investor Information: |

Download (Print version) |

Investment company

| Funds company: |

LGT Capital P. (FL) |

| Address: |

Herrengasse 12, 9490, Vaduz |

| Country: |

Liechtenstein |

| Internet: |

www.lgt.com

|

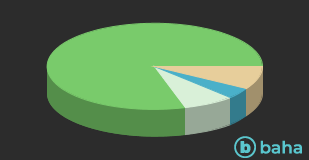

Assets

| Bonds |

|

64.12% |

| Stocks |

|

22.85% |

| Alternative Investments |

|

5.78% |

| Other Assets |

|

5.49% |

| Real Estate |

|

1.76% |

Currencies

| Euro |

|

79.61% |

| US Dollar |

|

7.84% |

| Japanese Yen |

|

3.92% |

| Others |

|

8.63% |