T.Rowe P.F.S.E.M.B.F.In(GBP)

LU1195378945

T.Rowe P.F.S.E.M.B.F.In(GBP)/ LU1195378945 /

| NAV2024-04-29 |

Chg.+0.0500 |

Type of yield |

Investment Focus |

Investment company |

| 11.6600GBP |

+0.43% |

reinvestment |

Bonds

Emerging Markets

|

T.Rowe Price M. (LU) ▶ |

Investment goal

The Fund’s objective is to maximise total return by investing primarily in a widely diversified, global portfolio of bonds and other fixed and floating rate securities issued by governments, government agencies, supra-national and corporate issuers established or conducting a significant proportion of their business activities in the economically emerging countries of Latin America, Asia, Europe, Africa and the Middle East.

Master data

| Type of yield: |

reinvestment |

| Funds Category: |

Bonds |

| Region: |

Emerging Markets |

| Branch: |

Bonds: Mixed |

| Benchmark: |

JP Morgan Emerging Markets Bond Index Global Diversified |

| Business year start: |

01-01 |

| Last Distribution: |

- |

| Depository bank: |

JP Morgan SE - Zweigniederlassung Luxemburg |

| Fund domicile: |

Luxembourg |

| Distribution permission: |

Austria, Germany, Switzerland, Luxembourg |

| Fund manager: |

Samy Muaddi |

| Fund volume: |

197.5 mill.

USD

|

| Launch date: |

2015-04-09 |

| Investment focus: |

- |

Conditions

| Issue surcharge: |

0.00% |

| Max. Administration Fee: |

0.50% |

| Minimum investment: |

2,500,000.00 GBP |

| Deposit fees: |

0.02% |

| Redemption charge: |

0.00% |

| Key Investor Information: |

- |

Investment company

| Funds company: |

T.Rowe Price M. (LU) |

| Address: |

100 East Pratt Street, MD 21202, Baltimore |

| Country: |

United States of America |

| Internet: |

www.troweprice.com

|

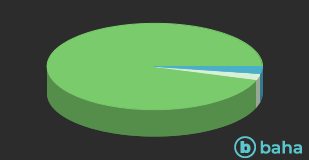

Assets

| Bonds |

|

94.94% |

| Cash |

|

2.35% |

| Others |

|

2.71% |

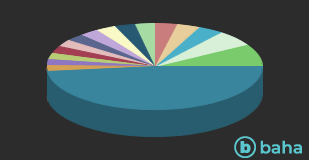

Countries

| Mexico |

|

8.54% |

| Indonesia |

|

6.03% |

| Panama |

|

3.75% |

| Colombia |

|

3.47% |

| Angola |

|

3.18% |

| Dominican Republic |

|

3.08% |

| Oman |

|

3.04% |

| Turkey |

|

2.96% |

| Egypt |

|

2.88% |

| Brazil |

|

2.78% |

| Cote d'Ivoire |

|

2.66% |

| India |

|

2.57% |

| Chile |

|

2.41% |

| Cash |

|

2.35% |

| Romania |

|

2.12% |

| Others |

|

48.18% |

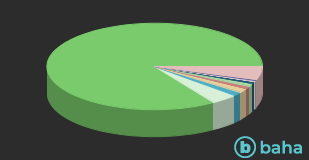

Currencies

| US Dollar |

|

84.32% |

| Euro |

|

4.09% |

| Mexican Peso |

|

1.44% |

| Chinese Yuan Renminbi |

|

1.40% |

| Indonesian Rupiah |

|

1.14% |

| Brazilian Real |

|

0.98% |

| Malaysian Ringgit |

|

0.81% |

| Colombian Peso |

|

0.27% |

| South African Rand |

|

0.24% |

| Indian Rupee |

|

0.23% |

| Others |

|

5.08% |