T.Rowe P.F.S.E.M.Corp.B.F.Ax(USD)

LU1670770483

T.Rowe P.F.S.E.M.Corp.B.F.Ax(USD)/ LU1670770483 /

| NAV2024-05-03 |

Chg.+0.0200 |

Type of yield |

Investment Focus |

Investment company |

| 7.4000USD |

+0.27% |

paying dividend |

Bonds

Emerging Markets

|

T.Rowe Price M. (LU) ▶ |

Investment strategy

To maximise the value of its shares through both growth in the value of, and income from, its investments.

The fund is actively managed and invests mainly in a diversified portfolio of corporate bonds from emerging market issuers. Although the fund does not have sustainable investment as an objective, the promotion of environmental and social characteristics ("E & S") is achieved through the fund's commitment to maintain at least 10% of the value of its portfolio invested in Sustainable Investments.

Investment goal

To maximise the value of its shares through both growth in the value of, and income from, its investments.

Master data

| Type of yield: |

paying dividend |

| Funds Category: |

Bonds |

| Region: |

Emerging Markets |

| Branch: |

Corporate Bonds |

| Benchmark: |

J.P. Morgan CEMBI Broad Diversified |

| Business year start: |

01-01 |

| Last Distribution: |

2024-04-19 |

| Depository bank: |

J.P. Morgan SE - Zweigniederlassung Luxemburg |

| Fund domicile: |

Luxembourg |

| Distribution permission: |

Austria, Germany, Switzerland, Luxembourg |

| Fund manager: |

Samy Muaddi, Sibu Thomas |

| Fund volume: |

185.13 mill.

USD

|

| Launch date: |

2017-08-23 |

| Investment focus: |

- |

Conditions

| Issue surcharge: |

5.00% |

| Max. Administration Fee: |

1.05% |

| Minimum investment: |

1,000.00 USD |

| Deposit fees: |

0.02% |

| Redemption charge: |

0.00% |

| Key Investor Information: |

Download (Print version) |

Investment company

| Funds company: |

T.Rowe Price M. (LU) |

| Address: |

100 East Pratt Street, MD 21202, Baltimore |

| Country: |

United States of America |

| Internet: |

www.troweprice.com

|

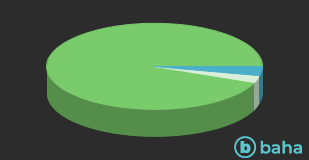

Assets

| Bonds |

|

93.92% |

| Cash |

|

2.61% |

| Others |

|

3.47% |

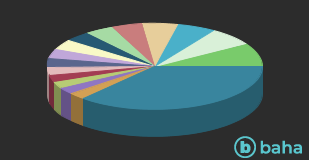

Countries

| Mexico |

|

8.81% |

| Netherlands |

|

7.02% |

| Chile |

|

5.75% |

| Cayman Islands |

|

5.28% |

| Indonesia |

|

4.65% |

| India |

|

4.36% |

| Mauritius |

|

3.83% |

| United Arab Emirates |

|

3.81% |

| Luxembourg |

|

3.54% |

| Philippines |

|

3.45% |

| Turkey |

|

2.86% |

| Cash |

|

2.61% |

| Thailand |

|

2.52% |

| Singapore |

|

2.51% |

| Peru |

|

2.44% |

| Others |

|

36.56% |

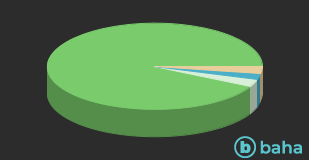

Currencies

| US Dollar |

|

92.41% |

| Euro |

|

2.83% |

| Hong Kong Dollar |

|

2.07% |

| Others |

|

2.69% |