Vanguard ESG Dev.W.All C.Eq.IF.I.Pl. EUR

IE00BFPM9S65

Vanguard ESG Dev.W.All C.Eq.IF.I.Pl. EUR/ IE00BFPM9S65 /

| NAV2024-04-30 |

Chg.-3.0892 |

Type of yield |

Investment Focus |

Investment company |

| 296.3169EUR |

-1.03% |

reinvestment |

Equity

Worldwide

|

Vanguard Group (IE) ▶ |

Investment strategy

The Fund employs a passive management - or indexing - investment approach, through physical acquisition of securities, and seeks to track the performance of the FTSE Developed All Cap Choice Index (the "Index").

The Index is a market-capitalisation-weighted index composed of large-, mid-, and small-cap stocks of companies located in developed markets around the world. Market-capitalisation has regard to the relative size of a company in terms of issued share capital.

Investment goal

The Fund employs a passive management - or indexing - investment approach, through physical acquisition of securities, and seeks to track the performance of the FTSE Developed All Cap Choice Index (the "Index").

Master data

| Type of yield: |

reinvestment |

| Funds Category: |

Equity |

| Region: |

Worldwide |

| Branch: |

Mixed Sectors |

| Benchmark: |

FTSE Developed All Cap Choice Index |

| Business year start: |

01-01 |

| Last Distribution: |

- |

| Depository bank: |

Brown Brothers Harriman Trustee Services |

| Fund domicile: |

Ireland |

| Distribution permission: |

Austria, Germany, Switzerland |

| Fund manager: |

Vanguard Global Advisers LLC, Europe Equity Index Team |

| Fund volume: |

4.8 bill.

USD

|

| Launch date: |

2013-12-06 |

| Investment focus: |

- |

Conditions

| Issue surcharge: |

0.00% |

| Max. Administration Fee: |

0.13% |

| Minimum investment: |

100,000,000.00 EUR |

| Deposit fees: |

- |

| Redemption charge: |

0.00% |

| Key Investor Information: |

Download (Print version) |

Investment company

| Funds company: |

Vanguard Group (IE) |

| Address: |

30 Herbert Street, D02 W329, Dublin 2 |

| Country: |

Ireland |

| Internet: |

www.vanguard.co.uk

|

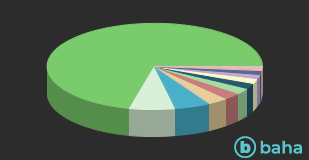

Countries

| United States of America |

|

71.20% |

| Japan |

|

7.00% |

| Global |

|

5.40% |

| United Kingdom |

|

3.00% |

| Canada |

|

2.60% |

| Switzerland |

|

2.30% |

| Germany |

|

2.00% |

| Australia |

|

1.90% |

| France |

|

1.60% |

| Korea, Republic Of |

|

1.60% |

| Netherlands |

|

1.40% |

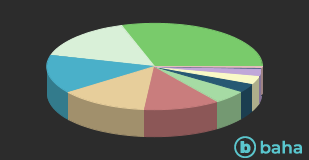

Branches

| IT/Telecommunication |

|

30.00% |

| Consumer goods, cyclical |

|

15.70% |

| Finance |

|

14.50% |

| Healthcare |

|

13.30% |

| Industry |

|

11.50% |

| Basic Consumer Goods |

|

5.10% |

| real estate |

|

3.30% |

| Telecomunication |

|

3.20% |

| Commodities |

|

2.60% |

| Utilities |

|

0.60% |

| Energy |

|

0.20% |